It’s been 36 years since Bangladeshi economist Muhammad Yunus started giving startup business loans to some of his country’s poorest would-be entrepreneurs.

Since then microfinance has become a darling of the international development community, credited with lifting thousands out of poverty and earning Yunus the Nobel Peace Prize in 2006.

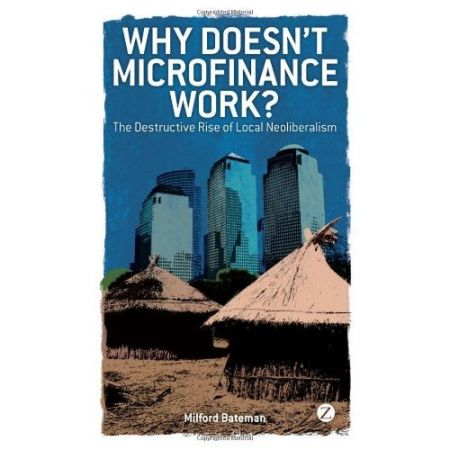

But it’s a false God, says Milford Bateman, a professor of economics at Juraj Dobrila University of Pula, Croatia and author of the provocatively titled book Why Doesn’t Microfinance Work? The Destructive Rise of Local Neoliberalism.

“Microfinance simply doesn’t work as it was supposed to,” says Bateman, who will deliver a lecture at St. Mary’s University on January 26th. “[I]t upsets me so much to see so much wasted effort and scarce financial resources used to support tiny micro-businesses, of which 90% quickly fail and plunge the poor into even deeper poverty.”

Local markets in the South are already saturated with struggling small businesses – street vendors and other informal traders, says Bateman. “If you set up lots more informal microenterprises, using microfinance…who will buy all this additional supply of simple products and services?”

In the end, microfinance ventures “take business away from [existing] businesses, meaning no [net] gain,” Bateman says.

“Prices also tend to go down, meaning that everyone is made worse off.”

Bateman’s book documents numerous failed microfinance projects from Bosnia to Bolivia. He says that microfinance’s few success stories are overwhelmingly outweighed by stories of deep debt, failed businesses and predatory creditors.

“[T]he logic in the world of microfinance is…based upon the jackpot winner idea,” says Bateman. In fact, he says, examples of truly successful micro-entrepeneurs are “very few indeed.”

“[A]s a consultant and researcher I have seen [examples of failure] far more than I have seen the positive successes. Overall, it is like going to Caesars Palace in Las Vegas and finding a jackpot winner, and then claiming that all the poor have to do is to go to Caesars Palace and you can escape poverty.”

Unsurprisingly, not all those who work with microfinance in the Majority World share Bateman’s gloomy views. Nanci Lee, who teaches a course in Community-Based Microfinance for the Coady International Institute at St. Francis Xavier University, admits she’s seen “good, bad and ugly in microfinance, like every other form of development.”

The challenge, she says, is in “whistle-blow[ing] the bad without losing what works.” Lee points to the Self Employed Women's Association Bank, a cooperative bank in India that is “part of a trade union of over 800,000 women, mainly illiterate, offering everything from old age pensions to daily savings accounts. Not without its own challenges, but if you ask any of those women, I bet you they'll tell you it works.”

While Bateman, in turn, acknowledges some major microfinance success stories – generally involving cooperative business models and careful government planning – most microfinance rests on a “deeply neoliberal worldview,” one which “positions [individual entrepreneurship] as the sole legitimate way for the poor to try to escape their poverty.”

“[W]e want the poor countries to stick to free market textbook policies, like microfinance…even though we in the rich world used extensive state intervention and collective effort to grow rapily and to become rich,” says Bateman.

“This is morally wrong…we expect them to do this because it is ideologically what we want to see and it is good for us and our economy (less competition), and not because it is good for them,” he adds.

Lee counters that those who dismiss microfinance are not seeing the need that it fulfills.

“I ask people who [equate microfinance with neoliberalism] if they have an ability to safely save and get access to money and if they've ever known poverty,” Lee says. Microfinance “just provide[s] more options” to the world’s poor.

“They want what we all want. Options.”

Milford Bateman will deliver a free webinar at 1pm and a public lecture at 7pm on Thursday January 26th, at SMU. Nanci Lee’s colleague at Coady, Anuj Jain, will be a special panelist on the webinar. Click here for more info.